|

Getting your Trinity Audio player ready...

|

Use of AI in the financial sector

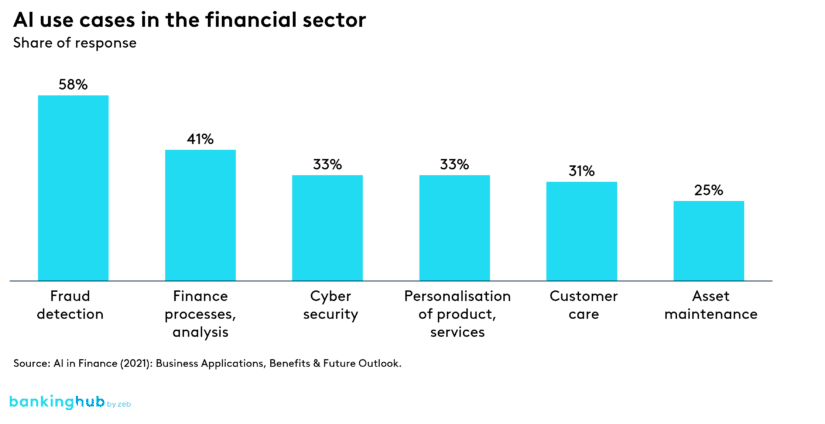

Two years ago, generative AI was still a novel concept, but now the industry has already adopted AI techniques in the areas of fraud prevention, data analysis, and cybersecurity.

Personalization and customer service are elements that can be further improved through the use of generative AI technologies in the coming years.

First, it can increase efficiency by streamlining processes. Second, it can create winners and losers based on who has access to the best data sets and the best AI tools to utilize them to drive revenue.

Possible applications of AI using Visa as an example

Cybersecurity

Visa has invested more than USD 10 billion in cybersecurity over the past five years, with about 10% of that budget spent on data analytics and AI. By the end of 2021, Visa had more than 60 petabytes of data, which is a huge source for analysis.

In addition to this large data set, the company uses more than 60 AI services to detect and prevent fraud on its network. One of these services is the Visa Advanced Authorization (VAA) score, which uses machine learning to determine whether a transaction is legitimate or fraudulent in less than 300 milliseconds. Visa’s maximum payment processing capacity is approximately 65,000 transactions per second. Reviewing that number of transactions and obtaining a fraud verification in 300 milliseconds is an impressive feat. According to Visa, VAA prevented fraud incidents totaling USD 26 billion in 2021.

Fraud prevention

Visa uses data to analyze patterns to determine whether a transaction is consistent with the user’s behavior. Fraud prevention is a trade-off between risk and return: False positives, such as transactions wrongly declined due to suspected fraud, are extremely costly. The Aite Group estimates that the e-commerce industry lost USD 443 billion due to false positives in 2021 – far more than the projected USD 6.4 billion in fraud losses.

Therefore, an AI model for payments must strike a balance between fraud prevention and business losses. If the model is too strict, business losses will go up. If the model is too lax, fraud losses will increase. This requires huge data sets and innovative machine learning models for their optimization. Every year, hundreds of millions of authentication requests are checked for millions of individual users. This data consists of behavioral, location, device and social data as well as many other relevant data points.

Risk profiles and behavioral analytics

Payment data is of tremendous value to all participants in the payment system. This data is very granular and allows for accurate risk profiling and behavioral analysis. Although Visa vehemently refutes this claim, the theory is often put forward that by analyzing payment data alone, the company would be able to predict a divorce long before it actually happens. Late-night taxi rides, online gift orders or last-minute hotel bookings can provide clues when such behavior doesn’t fit the normal patterns collected over the past few years. Visa does not record information about marital status, but it can be inferred from the data if necessary.

The high level of detail in payment data also has implications for larger payment transactions. When Alibaba wanted to take over MoneyGram in 2018, the US government blocked the deal. In many cases, payment data may not be stored outside of the country or continent in which it was collected.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Payment and data protection regulations (PSD3, GDPR and ADPPA)

Without the use of machine learning techniques, it would not be possible to sift through all this data to build systems like VAA. The new payment and data protection regulations in the EU (PSD3 and GDPR) and the US (ADPPA) create an interesting situation that benefits large technology companies. Data must be disclosed at the request of the data owner (i.e. the customer of a bank or the user of a big tech product or service). This means that large technology companies can gain access to payment data if the user so desires.

An example of this is Apple Pay, where payment data is shared with Apple. This gives big tech companies a huge competitive advantage over financial institutions in their battle for end customers. Big tech companies can create very detailed customer profiles by combining their own internal user data with the insights from the payment data. This can be used to better serve customers, but also to gain market share in competition by integrating financial services into the product offering. We have written about embedded financial services before, but it is clear that the more data, the better the training set for an AI and the wider the competitive gap.

Investments in AI

The fact that large payment companies are very advanced in the use of AI for fraud prevention is also reflected in their revenue profile. To stay with the Visa example: its financial statements show that it generates about one-fifth of its revenue from “value-added services”, which also includes fraud prevention. This is also the reason why it is very difficult (if not impossible) to replace these large payment networks. The fraud-related services alone would make their use worthwhile and give the payment networks a years-long head start on challengers. Even the central bank digital currency (CBDC) requires fraud overlays to function.

According to the Preventing Financial Crimes Playbook, Visa’s investment in AI is comparable to that of the financial services sector as a whole. This means that there are many other examples of financial institutions and the payments industry using AI in advanced areas. In 2020, financial institutions spent more than EUR 217 billion on AI applications in the areas of fraud and risk assessment. This figure is likely to have increased significantly with the integration of generative AI techniques into the customer service process.

It is clear that the integration of AI in the financial sector goes far beyond payment fraud prevention. Banks are also using AI techniques for general fraud prevention (payments, deposit opening, money laundering, lending, foreign exchange, etc.). KYC/AML processes are enriched with big data and AI techniques, and insurance companies are using the technology for underwriting and claims processing. For example, consider computer vision and deep learning tools used in applications that can automatically convert photos into claims reports.

Conclusion

The integration of AI technologies in financial services will continue to grow. Generative AI is an innovative and efficient technology that will likely be used to optimize customer engagement and programming by enabling the creation of interactive reports, where the algorithm creates customized dashboards by interacting with the end user.

In addition to generative AI, there is much more room for proprietary AI techniques and data sets. Visa is a clear example. These large payment networks have amassed a wealth of data over the past few decades, providing the perfect basis for optimizing processes and developing proprietary services with large defensive moats, as competitors cannot simply copy the insights they have gained. Large banks, asset managers, and insurance companies also have large data sets that they use to improve and personalize their services.

However, many financial institutions still have a long way to go because they lack the basics needed to take full advantage of AI technologies. These basics consist of data and methods for cleaning, labeling, storing and extracting the data. The first step for many financial institutions is to create data lakes that allow AI techniques to leverage all the internal and external data needed for optimal performance.