|

Getting your Trinity Audio player ready...

|

Gap between staff recruitment and staff retention

Project experience shows that banks are currently focusing on recruitment, or at best more broadly on talent acquisition. Processes are optimized, employer brands are polished. At the same time, it can be stated that while companies in the financial services sector have traditionally tended to complain about low staff turnover based on the small number of employees quitting their jobs, this rate is now rising sharply in many companies. Doubling figures are currently quite common.

Several aspects are particularly striking: In light of the increasing turnover and the declining supply of labor, talent acquisition will hardly be able to fully compensate for the accelerating outflow of capacity, even under current conditions. In addition, the optimization of talent acquisition is often not addressed in its entirety. In many cases, the issue is no longer considered once the contract is signed and certainly not after the first day of work. However, employee retention takes effect much later, so that there is often a gap in the concepts between acquisition and retention, with the obvious consequences.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

The “disloyal” Generation Z: ways to successfully retain employees

The overall situation is being significantly complicated by the self-image of the succeeding generation, i.e. Generation Z. According to a recent forsa study, 65 percent of this age group are not worried about their professional future “thanks to the shortage of skilled workers”. At the same time, this generation is also increasingly willing to change jobs. Currently, around one in seven Generation Z employees is actively looking for a job. On April 13, 2023, in the SPIEGEL magazine a labor market expert therefore referred to Generation Z as the most disloyal workers ever.

In ongoing financial services projects, we are currently measuring turnover rates of 12 to 15 percent in the group of employees with up to four years of service. Two developments will hence be overlapping in the next few years: Firstly, a high proportion of employees will have to be replaced due to demographic factors, meaning that the average length of service will decrease dramatically. Secondly, in the foreseeable future, “the replacement” will build up significantly less loyalty to the employer.

Financial services providers who believe they can solve this problem by optimizing talent acquisition (alone) will therefore fail.

Optimizing onboarding processes at banks

Many companies avoid optimizing their onboarding processes. The results of professional onboarding are perfectly measurable over time. But: the large number of people involved makes this process a hot potato. The specialist area, IT and HR, and often other departments, too, must mesh like clockwork. And who wants to take responsibility if they are not in a position to decide on the process?

Therefore onboarding, and thus the first stage of integrating new employees in the corporate culture, is often done piecemeal with fatal consequences. According to recent analyses by zeb, the average cost of filling a position in the financial services sector, taking all accompanying effects into account, amounts to around EUR 46,000. If you do not manage onboarding in a highly professional manner and thus do not establish clear process responsibilities, you will not create the necessary conditions for employee retention and thus ultimately burden the company’s bottom line.

Emotional attachment as a lever

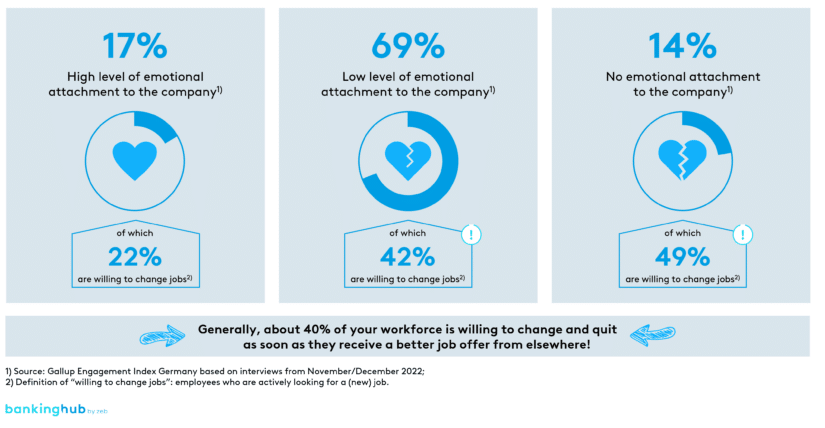

Recent studies state that salary remains the strongest trigger for quitting a job. According to the latest Gallup Engagement Index, 22 percent of employees with a high level of emotional attachment to their employer are willing to change jobs. However, when there is little or no emotional attachment to the company, the willingness to switch jobs increases toward 50 percent!

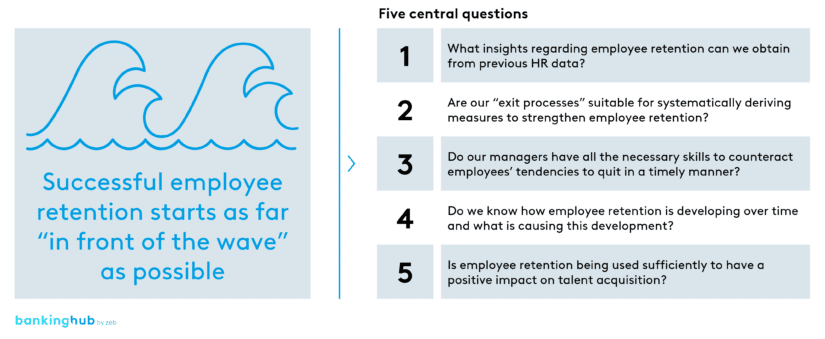

Considering the costs of filling a vacancy and the impact of emotional attachment, a focus on employee retention seems to pay off. The challenge here is to get “in front of the wave”, i.e. to understand the reasons for churn as thoroughly as possible and to derive targeted measures. Five questions are at the heart of this approach:

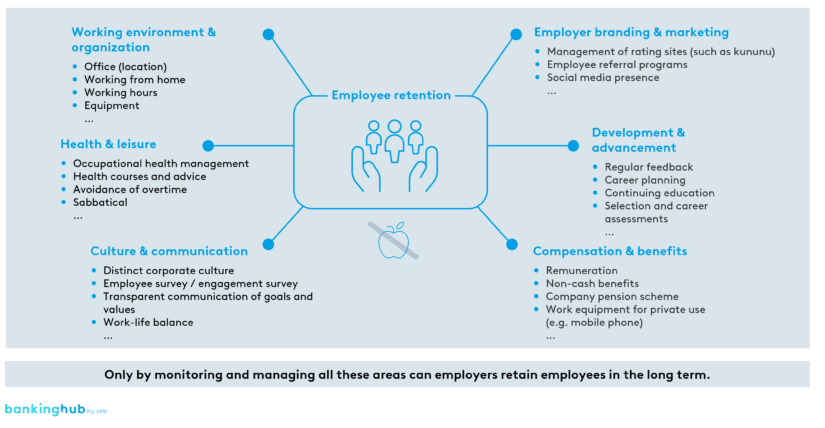

After all, according to the latest scientific findings, employee retention is influenced by a wide range of concepts, measures and behaviors. Tackling all of them would hardly be controllable in terms of complexity nor economically reasonable.

So, from an economic point of view, there is no one solution or one way, but each company has to analyze very precisely and farsightedly which levers should be used to increase employee retention. Fruit baskets and foosball tables are unlikely to do the trick:

Employee retention programs are a must

In light of the outlined future developments, employee retention programs are not an option for banks, but a must. The challenge is to make these programs manageable and controllable.

According to zeb’s extensive project experience, employee retention programs in particular require a thorough analysis in order to determine priorities and subsequently measure effects on performance. This approach helps you gradually get “in front of the wave” while not overwhelming the organization.

In addition to a continuous measurement of the effect of individual measures, this approach requires time. Because organizations need to overcome their moment of inertia. In view of the SPIEGEL report and the forsa study, companies that are not yet working hard on retaining their employees should put it on their agenda very soon.