|

Getting your Trinity Audio player ready...

|

Status quo and objectives of process management in regional banks

Process management continues to be a crucial issue in regional banks – regardless of whether the focus is on the cooperative or savings banks sector. More than 90% of the study participants rate process management as important or very important. However, a few things have changed since the last study in 2019: Back then, the focus was primarily on proper implementation and governance, but by now process management has established itself as an important organizational element of most regional banks.

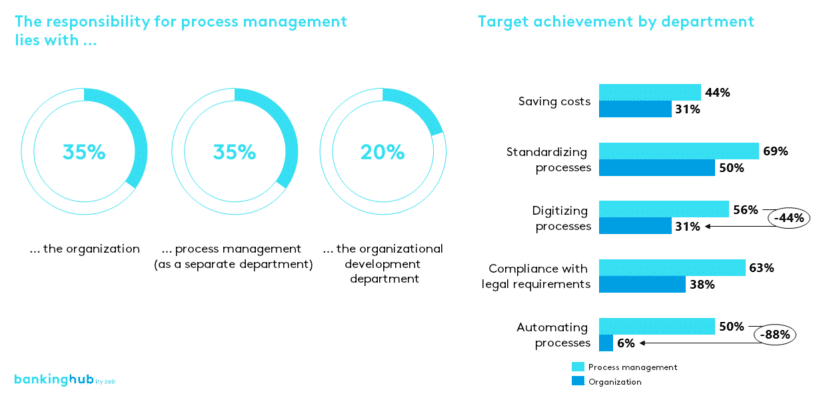

The current challenges relate to further development and the long-term impact within the company. Reduction of costs, as well as standardization and digitization of processes are among the top objectives. Those three goals have not yet been fully achieved to date, although overall target achievement has improved since 2019.

Process responsibilities in banks

The study shows that with increased complexity in process-related issues, it makes a considerable difference where process management is located within the bank’s organizational structure. For example, institutions that have established a dedicated process management department achieve significantly better results in terms of target fulfillment than those that leave the responsibility to the organization as a whole.

Due to the demands and the variety of topics, effective process management requires resources and a high degree of professionalization. This is also reflected in the increasing establishment of process-related roles. The role of “process manager” in particular is now significantly more established than in 2019 (80% in the 2022 study, 57% in 2019).

Half of the institutions have process teams, ideally consisting of three people:

- Process organizer to ensure both technical and methodological competencies in the process team

- Front office process owner to consider and focus on customer demands in the course of process optimization

- Back office process owner for compliance with the technical and regulatory requirements in the process

This lineup is intended in particular to ensure practical relevance in process adaptations, see also our linked article below.

The allocation of fixed roles helps to create a sense of responsibility and establish a consistent roster of contact persons. However, these roles must also be given sufficient authority. In one out of two institutions, the respective executive still makes the final decision on process changes.

The study reveals that cooperative and savings banks that transfer decision-making authority to their process management staff show significantly better results in terms of target achievement. This is particularly due to the fact that the decision-making and implementation paths are shortened and optimizations can be implemented more efficiently when those who are most familiar with the crucial issues and have the most operational experience are in charge from conceptual design to implementation.

Such decision-making authorities should be carefully assigned and secured by a restriction catalog. Executives can be involved in more extensive projects in a resource-efficient manner. For many institutions, this is a completely new approach and a change in work culture. Thus, the support of the board is critical to success.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Process architecture and CIP

Cooperative banks and savings banks differ significantly in one respect: while savings banks almost exclusively use the data center’s standard processes, cooperative banks take a more individual approach. 91% of the cooperative banks have individual ways to manage their lending processes; with regard to deposit-taking processes, the rate is 79%.

In our current projects in this area, we are often asked whether process management is just a temporary means to an end. The study participants’ response matches our own: over 90% believe that process management will not become obsolete as a result of centralized provision of processes. It will continue to play an essential role, only the requirements are changing.

Most institutions are not yet able to predict how their process management will develop in the future. 60% of respondents say they have no clear idea of what the business processes of the future will look like at their institution. This applies in particular to the cooperative banks.

Regardless of how business processes are set up and designed in the future, they require ongoing optimization in the sense of a continuous improvement process (CIP). Adjustments to products, new regulatory requirements, different customer needs, and changes in the technical environment call for constant adaptation of processes. Even though all institutions consider continuous process optimization important, only 30% review their own processes on an annual basis.

The implementation of process teams improves the continuous optimization through the decentralized distribution of tasks. With an appropriate standard procedure model and a suitable methodology, the optimization, mapping, visualization and continuous improvement of processes can be harmonized in an uncomplicated manner.

Process controlling and management

91% of the institutions surveyed rate the use of process controlling as important to very important. So it is all the more surprising that only 28% have implemented active process controlling. Although the institutions are actively working on the processes and their optimization, they do not have an overview of the effects of their adjustments or the real relevance of the business processes. Process management always means change – and change initiatives require transparency of results.

But why is this transparency not always provided? Half of all institutions mention limited technical analysis capabilities or excessive implementation costs in this regard. However, the core banking system at cooperative and savings banks already provides all relevant information by default via the available reporting options. This information can be transferred to a controlling tool and automatically analyzed without much effort. The amount of resources needed for implementing such a tool is manageable and ongoing analyses can be largely automated.

Institutions that already actively work with process controlling use the results primarily to derive measures for process optimization. Half of the institutions surveyed discuss the findings from process controlling in team meetings. Only a few use the data for employee capacity management or strategic progress review. In summary, it can be seen that the available potential in process controlling is currently still not fully leveraged.

Intelligent automation

In the study, the topic of “intelligent automation” was only addressed to the cooperative banks. Among savings banks, very few are concerned with this topic, since they primarily use the processes offered by their IT service provider, which in contrast to the processes in the cooperative sector, have a high degree of automation.

At cooperative banks, intelligent automation is considered relevant by almost all respondents. 53% of participants use Robotic Process Automation (RPA); 6% even use RPA and artificial intelligence (AI) in combination. Banks have recognized that, in addition to enabling efficiency and quality gains, intelligent automation is also a way to circumvent the shortage of skilled workers.

Intelligent automation is used by cooperative banks in the lending business back office (89%), deposit-taking business back office (79%) and front office (74%). 65% use more than ten automated processes and are thus already in the professionalization phase. After the piloting phase, rapid growth is needed to unleash the full potential and establish the new tools in the institution. If not enough attention is paid to further development (technically, organizationally and in terms of communication), the newly introduced technology may quickly lose traction.

In the lending business in particular, there are extensive use cases for intelligent automation that are no longer dreams of the future:

Cooperative banks that have not yet implemented intelligent automation mainly argue that they prefer to wait for solutions from the data center (79%) or that they lack human resources (71%). Obviously, making use of the potential process efficiencies and competitive advantages from RPA requires investment and resource commitment. The potential that can be achieved depends on the size of the bank, its process landscape, its quantity structures and its business model, and must therefore be determined individually for each bank. Every bank would be well advised to carry out a preliminary study in this area.

Success factors and process culture

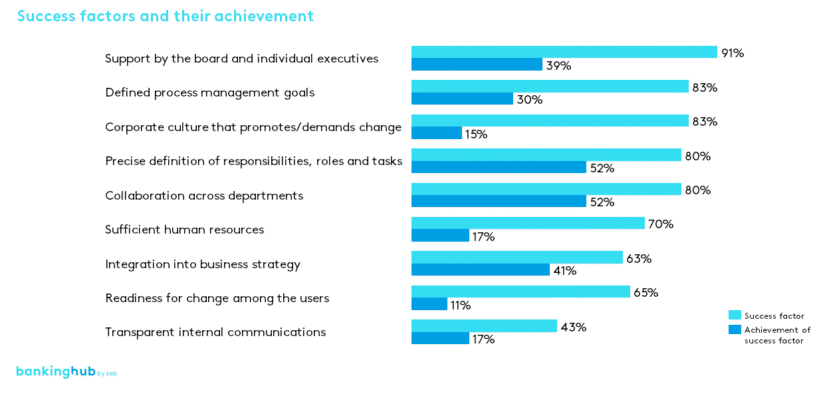

Regardless of how well process management is set up organizationally or how well the processes are administered technologically, the impact of process optimization, as with many change initiatives, depends on the people. Work processes are being (disruptively) changed, authority is being transferred to employees, and executives are increasingly relinquishing responsibility for processes. In the course of these changes, there is repeated talk of a process culture – but this culture does not establish itself overnight. It requires good communication and participation opportunities for employees.

Only when the benefits of process management are fully understood can long term success be achieved. Very few cooperative and savings banks have a comprehensive process culture: at 80% of the institutions surveyed, only a few employees are involved in the topic, varying across departments.

A corporate culture that promotes change is therefore an important factor for successful process management, according to 83% of the respondents. Target achievement in that regard is appalling: only 15% say that such a corporate culture exists at their institution. There is only one issue more important than that: support from the management board and the individual executives. Implementing and working on process management means change. Thus, authorities, roles, responsibilities, goals and restrictions must be clearly agreed upon with board members and executives from the very beginning and taken into account on a long-term basis.

Future of process management in regional banks – conclusion

The respondents agree that process management will remain an important issue in the future. Nowadays, almost every institution actively uses process management. The cooperative and savings banks know what they want to achieve, but they still have a long way to go. For the further development of process management and the realization of competitive advantages, a targeted expansion plan with development stages and consolidated process governance is necessary.

If you are interested in further developing your process management, we will be happy to support you with our expertise from a wide range of process management projects in cooperative and savings banks. Feel free to contact us!