|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

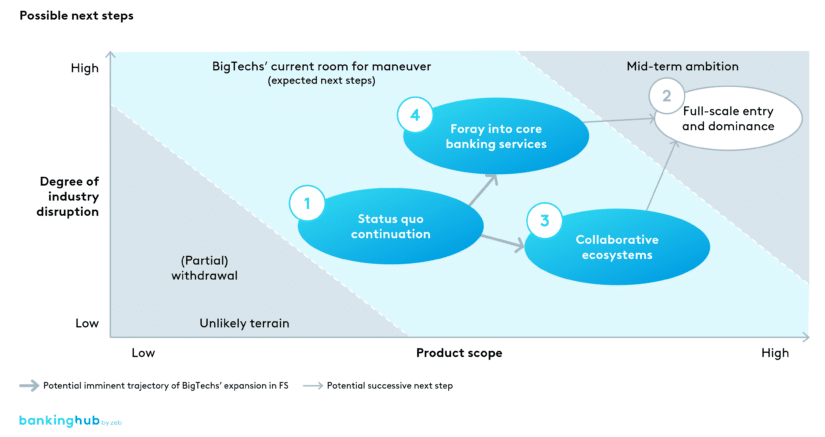

The following figure shows a graphical depiction of the logical next steps for BigTechs in financial services.

Status quo continuation

In the ‘status quo’ scenario, BigTechs are expected to maintain their current degree of involvement, avoiding significant expansion or withdrawal. Their product offerings would focus on bolstering their core business and targeting ‘quick wins’, with limited (further) impact on incumbents.

zeb assessment: It is unlikely for the status quo to continue for a long time. The resources that have already been invested by BigTechs to enter the market as well as the future market potential are significant and thus BigTechs are not expected to maintain their level of involvement without expansion. Furthermore, the volatile market dynamics force all players in the financial service sector to keep innovating in order to stay relevant and at least keep their market share.

Full-scale entry and dominance

At the other extreme, the full-scale entry and dominance scenario would see BigTechs plunging headlong into the financial services industry with comprehensive operations aimed at market dominance. Almost no financial service offering would remain untouched, and incumbents would find themselves in direct competition along their entire product catalog. This drastic shift would disrupt the industry at its core, potentially establishing BigTechs as the primary choice for customers’ financial service needs.

zeb assessment: This scenario is also unlikely to occur for two major reasons. Firstly, establishing a fully fletched bank including all licensing involves navigating complex regulatory frameworks in different, already highly regulated, countries. BigTechs would need to fully comply with banking regulations across jurisdictions, which is challenging, highly time consuming and not very scalable.

BigTechs’ advantage of a short time to market for products would not be sustainable in this scenario. Secondly, financial services are not at the core of BigTechs’ business models and in full alignment with their strategic priorities, but rather seen as an opportunistic chance to expand their ecosystem.

Collaborative ecosystems

BigTechs and incumbents revolutionizing financial services together

In the realm of collaborative ecosystems, BigTechs infiltrate the financial services sector by forging strategic alliances with incumbent players across diverse product categories. These partnerships, fusing BigTechs’ technological prowess with the incumbents’ financial acumen, have the potential to deliver superior solutions, revolutionizing customer experience. By leveraging incumbents’ white-label products under their own brand, BigTechs can offer a comprehensive product portfolio, as exemplified by ‘Apple Cash’, Apple’s savings account and digital card available in the USA.

For incumbents, partnering with BigTechs presents a golden opportunity to seize a first-mover advantage. Legal barriers within the financial sector necessitate BigTechs to rely on partners for product categories requiring banking licenses, especially for executing a quick market entry. Incumbents that ignore this opportunity could find themselves competing against powerful collaborative networks forged between their competitors and BigTechs.

zeb assessment: This scenario is the most likely one. With already launched products, such as Apple Cash in the USA and the opportunity to combine leveraging their data processing and ecosystems with regulatory compliance through a third party, this offers the best of both worlds from the perspective of the BigTechs. This scenario fits most likely with players such as Apple, Google or Meta whose key skills and levers are the integration of services into their ecosystems and who may rely on white-label solutions from third parties for the operations part.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Foray into core banking services

BigTechs offering core banking services and competing with incumbents

In contrast, the ‘foray into core banking’ scenario sees BigTechs entering the market by crafting their own products and potentially infrastructure, triggering intense competition with incumbents. This bold move requires BigTechs to acquire banking licenses and establish full-fledged banking operations. Their product offerings would encompass core banking services such as deposits, lending, and payments.

This innovation-driven scenario could raise consumer expectations regarding the quality and cost of services, posing the risk of customer migration from incumbents to BigTechs. However, it also presents an opportunity for incumbents to leverage the innovative milieu to enhance their offerings and retain their loyal customer base by focusing on their core strengths and personal services.

zeb assessment: Less likely scenario compared to ‘collaborative ecosystems’ but still poses a relevant threat. While a ‘full-scale entry and dominance’ scenario is heavily influenced by plenty of country-specific regulations, for simpler products such as deposit accounts the regulations vary less. This, for example, allows other FinTechs such as N26 or Revolut to serve customers across the European Union with no to little country specific adjustments to their services.

This scenario allows BigTechs to include simple banking products into their ecosystems and leverage their data processing capabilities for large customer bases. This path would fit best with the BAT companies, who serve their customers from a single source as well as the purely scalability-focused Amazon.

Implications and strategies for incumbents

Navigating the rapidly evolving financial services landscape and the threat of BigTechs’ activities presents a formidable challenge for incumbents. However, those who acknowledge this looming threat and take proactive measures are best positioned to weather the storm.

As BigTechs continue to redefine the financial services industry especially outside of Europe, incumbents all around the globe must respond with agility and foresight. By acknowledging the threats and opportunities presented by this digital revolution, traditional financial institutions can strategize effectively to retain their competitive edge and ensure sustainable growth.

Recognizing the value of strategic partnerships with BigTechs, leveraging their existing and unique strengths, focusing on customer-centricity, and enabling digital transformation will be key to navigating the path ahead.