|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Exploring BigTechs’ footprint in the financial services industry

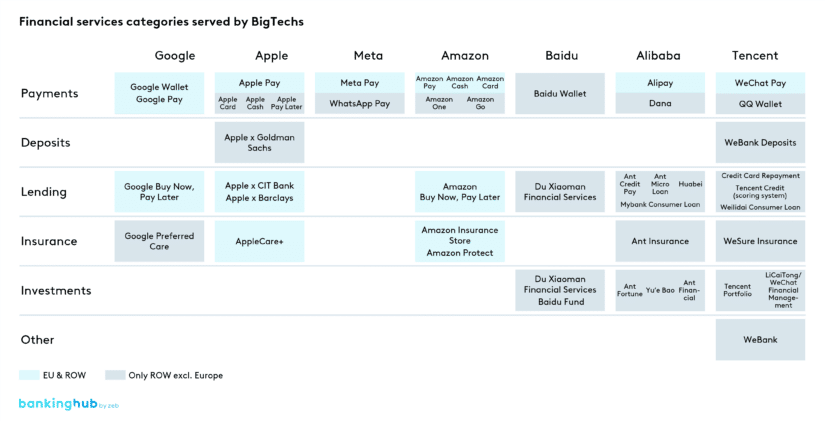

BigTechs have established a formidable presence in the financial services sector, predominantly outside the European realm, with Chinese enterprises spearheading the charge in both the volume and sophistication of their products. Their entry into this sector has been driven by the aim to expand their existing ecosystems and solidify customer loyalty, with each BigTech firm adopting a different strategy unique to their strengths and goals. Figure 1 displays a snapshot of the financial products that BigTechs are offering within and outside of the EU sorted by product category and company.

In the Western markets, GAMA companies are exploring the financial services industry with strategic initiatives. For instance, Google’s ‘Google Pay’ and Apple’s ‘Apple Pay’ have revolutionized digital payments, and Amazon has dipped into the aggregator business model with the ‘Amazon Insurance Store’. Meta, despite its primary focus on social networking, is also exploring payment services with ‘Facebook Pay’ and ‘WhatsApp Pay’. Furthermore, Apple’s introduction of the Apple savings account ‘Apple Cash’ shook the banking industry with its high yields.

Conversely, the Chinese BAT companies have rapidly ingrained themselves into every facet of the financial ecosystem in the Asian market. Baidu has its wealth management platform, ‘Baidu Wealth’, Tencent operates WeBank, the biggest digital bank in China that offers everything from payments to loans, and Alibaba has its affiliate Ant Group, a dominant player in the world of digital payments, handling ‘Alipay’.

The approach varies across geographical boundaries, with some BigTechs piloting their innovative financial products in North America or other markets before venturing into Europe. Under a different regulatory environment, BAT companies actively roll out a range of financial services within their home country. This expansion of BigTechs into the financial world showcases their growing influence and the transformative power they hold over global financial services.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Consumer sentiment and BigTechs’ emergence

Eroding trust advantage and future threats to financial incumbents

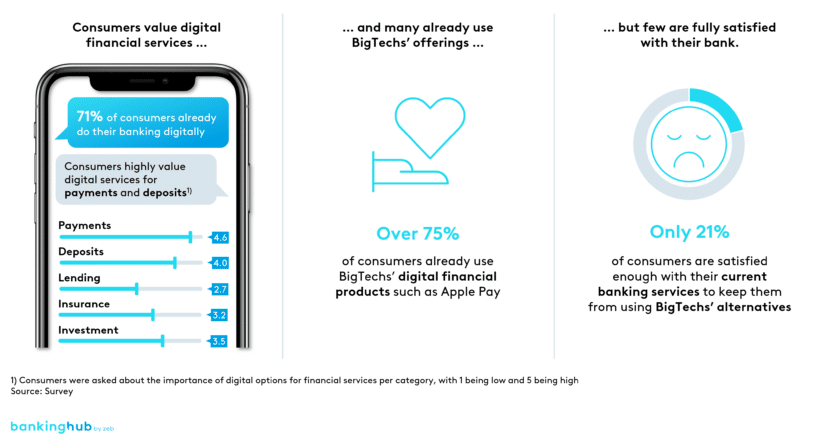

Exploring what consumers think of BigTechs’ activities in financial services provides insights into potential challenges faced by incumbents. Therefore, we conducted a consumer survey focusing primarily on Gen Z and millennial viewpoints, as they represent the future customer base. A discernible trend towards digital financial services emerges, with a notable dissatisfaction with the current offerings of traditional financial players.

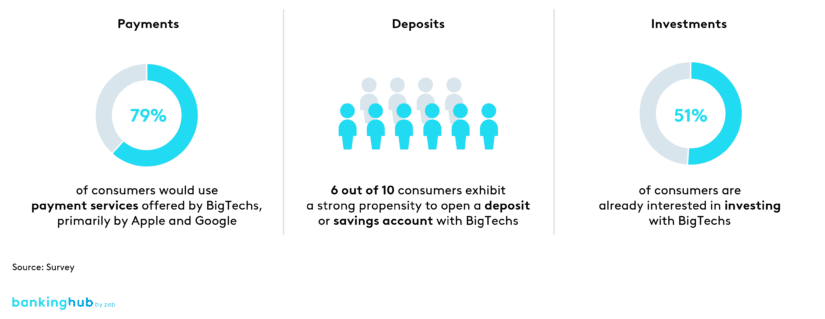

Although BigTechs’ reach in Europe may not be as extensive as in other markets, the impact is palpable. A significant 75% of respondents already use digital financial products from BigTechs, such as ‘Apple Pay’ or ‘Google Pay’, to some extent (figure 2). As consumers across various financial sectors prioritize monetary benefits and robust security, BigTechs, armed with their unique capabilities, are effectively positioned to address these demands.

The crux of consumers’ openness to embracing financial services from BigTechs revolves around trust. Intriguingly, our survey revealed that levels of trust placed in BigTechs are similar to those put in established incumbents. Apple emerged as a beacon of trust among the BigTechs with an average level of trustworthiness of 3.7 on a scale of 1 to 5 – equal to the control group of incumbents. This mirrors a shifting landscape where the trust advantage, once a unique selling proposition of incumbents, is progressively being eroded.

The impending threat of BigTechs entering and potentially dominating core banking services, notably payments and deposits, looms large. Around 6 out of 10 consumers exhibit a strong propensity to open a deposit or savings account with BigTechs according to the survey (figure 3). Particularly, the technologically adept and younger demographic showcases a readiness to adopt BigTechs’ financial services. This indicates a potentially turbulent future for incumbents in both retaining and attracting these tech-savvy consumer groups if they fail to take action.

An additional threat? BigTechs and Generative AI

Generative AI has been making significant strides not only in the tech industry but also in the fields of financial services and retail banking. Generative AI refers to a class of artificial intelligence techniques that can generate new content, such as text, images, or even financial data, resembling patterns and structures found in the training data it was exposed to. BigTechs are at the forefront of generative AI, e.g. with Google’s Bard, and can incorporate these technologies in their financial services offering in various ways, for instance:

- Customer interaction / User experience: In retail banking, generative AI can be used to generate personalized responses to customer inquiries, enhancing the customer experience. Chatbots powered by generative AI can simulate human-like conversations and provide relevant information to customers 24/7. BigTechs such as Apple already utilize generative AI to improve user experience by creating personalized interfaces, layouts, and design elements based on user preferences and behaviors.

- Customer behavior prediction: By analyzing past customer behavior, generative AI can predict future behaviors, such as purchasing trends or account closings, which is used by Apple and Google Pay. This information is strategically utilized for targeted marketing campaigns and retention strategies.

- Personalized financial advice: Generative AI can potentially analyze a customer’s financial history, goals, and risk tolerance to generate personalized investment or financial advice. This can help customers make more informed decisions aligned with their unique circumstances. Baidu Wealth Management already uses AI technology to analyze user risk profiles and improve their recommendations whereas the German robo-advisor service VisualVest announced being the first firm to integrate ChatGPT into their automated services in early 2023.

Overall, BigTechs with data at the core of their business have been exploring and innovating generative AI techniques continually. With the latest technological advancements in this field, those companies can easily leverage the already existing and emerging AI technologies for their financial products. This gives BigTechs a technological competitive edge over traditional players and allows them to quickly improve, advance their product, and react to customer demands to help them gain market share with a high degree of scalability.

Read our second article on the potential trajectories of BigTechs

From maintaining the status quo to outright dominance, our scenario analysis explores the possibilities for BigTechs in the financial services industry. Different BigTechs may choose different paths to leverage their unique capabilities.

Find out more about collaborative ecosystems and forays into core banking services, as well as the implications for traditional incumbents:

![Thede Küntzel, Manager Projects & Innovation at Sparkasse Bremen and Managing Director of ÜberseeHub GmbH.]](https://en.bankinghub.comlounge.dev/wp-content/uploads/2023/04/thede-kuentzel-bankinghub-scaled.jpg)