|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

State of the banking industry

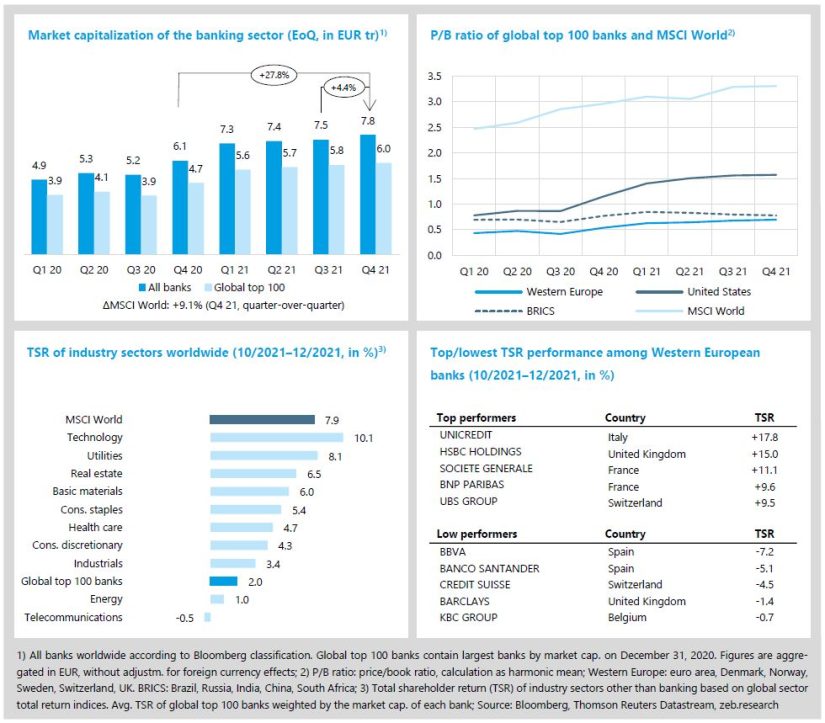

- In Q4, global capital markets showed the strongest performance of the year, thus defying concerns about the new Omicron variant and persistent inflation: MSCI World TSR +7.9% QoQ, market cap +9.1% QoQ.

- The global top 100 banks ended the quarter significantly worse (TSR +2.0% QoQ), but looking at the full year 2021, they showed a remarkable TSR of +30.2% YoY, significantly outperforming the market (MSCI World TSR +22.3% YoY).

In the final quarter of the year, global capital markets showed the strongest performance of the year (MSCI World TSR +7.9% QoQ, market capitalization +9.1% QoQ) and thus defied concerns about the spreading new COVID-19 Omicron variant and persistent inflation. The global top 100 banks developed significantly worse but ended the quarter with a solid TSR of +2.0% QoQ (market capitalization +2.4% QoQ).

Looking at the full year 2021, the global top 100 banks turned out to be crisis-proof and bounced back from the previous year’s lows with a remarkable TSR of +30.2% YoY (MSCI World: +22.3% YoY) – and prospects of rate hikes and green financing opportunities even make the sector interesting for 2022 and beyond.

- Market capitalization of the global banking industry kept climbing to new heights. In Q4 2021, global top 100 banks’ market capitalization reached EUR 6.0 tr (+27.9% YoY). The market cap of the overall global banking industry increased to EUR 7.8 tr (+27.8% YoY, +4.4% QoQ), the highest value since Q4 2017.

- Among global top 100 banks, Western European banks again showed the strongest quarterly TSR of +4.7% QoQ on average (U.S. banks +1.8% QoQ, BRICS banks -1.7% QoQ). However, for 2021, U.S. banks are ahead with a full year TSR of +40.8%, followed by Western European banks with +37.8% YoY and BRICS banks with just +8.4% YoY.

- Western European banks’ average valuation remained low at just 0.70x and recovered only slowly (+0.02x QoQ, +0.16x YoY), especially compared to U.S. banks with an average P/B ratio of 1.57x (+0.01x QoQ, +0.42x YoY).

- Unicredit is the European top performer in Q4 2021, showing a quarterly TSR of +17.7% (+79.6% YoY). A promising new strategy and the commitment of significant capital returns pushed the shares in the final weeks of the year.

Economic environment and key banking drivers

- Ongoing supply chain disruptions and the fourth wave of coronavirus infections have dampened expectations about future growth.

- Inflation is much more stubborn than expected and should peak in the final quarter of 2021. Major central banks like the Fed but also the ECB are preparing first monetary tightening measures, and capital market rates have reacted accordingly.

- In the third quarter of 2021, the largest global banks again posted strong results – Western European banks’ average ROE +9.5% (+2.0%p YoY), U.S. banks’ average ROE +14.8% (+3.8%p YoY).

Global economic development is still affected by the COVID-19 pandemic. The economic recovery lost some momentum in the third quarter of 2021 but still remained strong (Western Europe: +4.3% YoY; U.S.: +4.9% YoY).

However, ongoing supply chain disruptions and the fourth wave of coronavirus infections have dampened expectations about future growth. Inflation is also much more stubborn than expected and should peak in the final quarter of 2021. Major central banks are preparing first monetary tightening measures, and capital market rates have reacted accordingly.

- The new Omicron variant has increased the risks for economic growth, and expectations have been revised downwards. However, the negative impact of the pandemic and global supply bottlenecks is expected to diminish in the upcoming quarters. GDP growth in Western Europe is likely to improve by +6.1% YoY in Q1 2022 (U.S.: +4.0% YoY).

- Across all major regions, inflation will show a further significant increase in the final quarter of 2021. Western European inflation rates are expected to reach +4.1% YoY in Q4 2021 and U.S. rates even +6.6% YoY. Inflation pressure will also remain high in 2022, and Western European rates will not fall below 2.0% until Q4 2022.

- Since December 2021, the U.S. yield curve has shifted significantly upwards, especially for shorter terms, as the U.S. Fed prepared markets for three possible rate hikes in 2022 as well as a tapering asset purchase and balance sheet reduction. The euro area yield curve increased similarly and is now in the positive range for maturities larger than 5 years. Although euro area rate hikes are unlikely for 2022, the ECB will wind down the pandemic emergency buying program.

- EUR lost strongly against USD and CHF. The EUR/CHF rate fell below 1.04, the lowest value in almost 7 years.

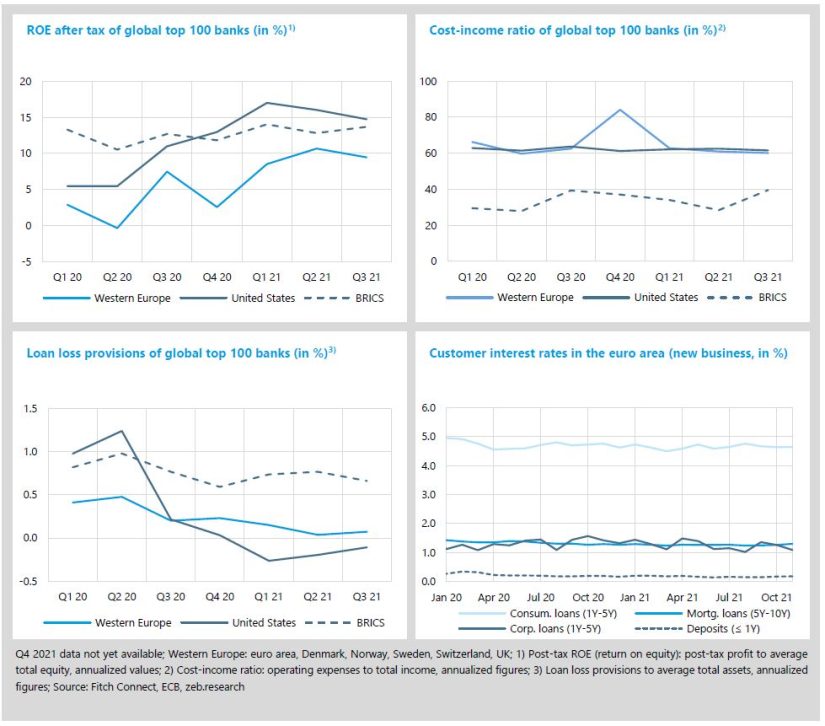

In the third quarter of 2021, the largest global banks again posted strong results. Although the profitability of U.S. and Western European banks slightly lagged the previous quarter, it improved significantly compared with a year earlier. Developments of banks’ loan loss provisions (LLPs) remain an important factor here as several banks still reported very low and even negative Q3 risk provisions.

The emergence of Omicron and a slower than expected economic recovery could lead to increased caution and pressure on Q4 results but the banking sector should end the year 2021 on a positive note.

- As business starts to return to normal, the average profitability of Western European banks normalized in Q3 but improved year-on-year by +2.0%p to +9.5%. U.S. banks still reached a strong average ROE of +14.8% (+3.8%p YoY) and BRICS banks’ ROE improved to +13.7% (+1.0%p YoY).

- In Q3, Western European banks’ average cost-income ratio declined further to 60.2% (-0.7%p QoQ, -2.4%p YoY). Compared to the previous year, Western European banks’ revenue grew by +6.5% YoY in line with a slightly higher cost base of +2.5% YoY. U.S. banks’ revenues increased by +9.1% YoY and costs by +5.5% YoY leading to a cost-income ratio of 61.6% (-1.7%p YoY).

- Western European banks’ risk provisions increased by +0.04%p QoQ to just 0.07% on average in Q3 while U.S. banks released provisions by -0.11% on average (+0.09%p QoQ). Q4 provisions, however, are expected to rise again, driven by seasonal effects as well as increasing economic uncertainties due to the new Omicron variant.

- Euro area mortgage loan rates reached 1.3% at the end of November 2021, the highest value for more than a year. However, overall yield curve effects are not yet reflected in euro area customer interest rates, but should be expected for Q1 2022.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Special topic

The green investment challenge

- To achieve the ambitions set out in the Paris Agreement, one thing is quite certain: massive investments across many industries are needed.

- The banking sector is seen as a fundamental part of this green transition, but do banks have sufficient capital to fulfill this important task?

- Green investments could lead to a significant increase in bank loans and corresponding risk-weighted assets, thus burdening banks’ capital ratios.

- Capital and balance sheet management will be key in order to participate in green growth opportunities, but further regulatory support or increased involvement of capital markets may be required.

To achieve the ambitions set out in the Paris Agreement, one thing is quite certain: massive investments across many industries are needed to reach net zero. The banking sector is seen as a fundamental part of this green transition; it is to control green activities, decide on green investments and finally become an ally in the green restructuring of the economy.

For the banks, however, this entails not only opportunities but also great challenges. Besides their own challenging task of becoming net zero, do banks have sufficient resources, especially capital, to fulfill this important role?

The green transformation of the global economy will be the biggest challenges of the next decades. The required global investment needs are still hard to quantify but will definitely be of significant size. A comparison by Autonomous Research shows that, depending on the considered industry sectors and ambition levels, current estimates vary between USD 1.0 tr and nearly USD 7.0 tr per annum.[1]

According to current figures by the EU Commission, we assume that total investments of around EUR 1.1 tr p.a. could be needed in the European energy system alone to reach the latest 55% GHG reduction targets by 2030. The identified key sectors are Transport (shows the currently lowest share of renewable energy use), Residential (in general responsible for 40% of final energy use) and Tertiary (high demand in fossil fuels).[2] These required investments will at the same time trigger significant financing needs across the industries. As a result, banking clients and investors will demand corresponding products, expecting banks to act as lenders of this green transition.

For the banking sector, this would imply a growth opportunity that could translate into a new and meaningful earnings wallet. However, are banks able to handle this potential green growth at all, i.e. do they have sufficient capital buffers?

Of course, investment needs are not the same as financing needs, and banks’ capital ratios will only be impacted if financing leads to new or additional loans, thus increasing risk-weighted assets (RWA). The additional net investments for the green transition are even more difficult to estimate but should represent the majority of the above-mentioned figures. As companies can use different ways of financing, the final funding structure of the investments should be taken into account as well. Across the European Union, for instance, companies fund the majority of their investments via internal finance (e.g. operating cashflows or savings).

Regarding external finance, bank loans are by far the most important source of funding on average. However, looking at the sheer size of the expected investment volumes, companies will not be able to maintain the current share of internal financing. Thus, for Europe, it can be assumed that the majority of the additional financing needs will be covered by bank loans.

Although it is difficult to make exact statements, some studies show that the green transition will lead to a significant increase in loan growth over the next 30 years. For instance, based on a recent publication of Autonomous Research, the annual growth of European bank loans could increase by ~60% to +2.3% p.a. for the next 30 years.[1] A corresponding significant increase in risk-weighted assets would then also burden banks’ capital ratios.

At first glance, the capitalization of European banks looks very strong, indicating enough room for such loan growth opportunities. Due to higher capital generation, the average capital ratio of Europe’s top 50 banks even increased during the COVID-19 crisis, reaching 15.3% at the end of the first half of 2021, far above the estimated market requirements of around 12-13%. However, it remains to be seen whether this level can be maintained for the upcoming green transition.

Firstly, in addition to the implementation of the final Basel III framework, there will also be a stronger focus on capital requirements for climate risks in the near future. European and UK regulators are already discussing how to explicitly capture climate risk in such a regulatory framework, e.g. by introducing a further climate risk buffer. Secondly, after the ECB has lifted the dividend restrictions, at least listed banks will have to return cash to their shareholders via increasing dividends and/or share buy-backs. Thirdly, a still impending COVID-19 impact – including the emergence of Omicron – continues to pose a risk of losses due to higher LLPs and increasing RWAs in the next 12-18 months.

Capitalization will therefore move up banks’ agendas again – especially for institutions with already rather low capital buffers and/or low profitability. Capital formation will remain a key element in this context. The expected further loan growth needs to translate into corresponding higher earnings, otherwise retained earning ratios must be increased significantly or (if possible) the way to the capital market must be sought directly.

In addition, the banks’ own risk management framework and net zero ambitions can lead to further constraints. Some investments are needed in rather carbon-intensive industry sectors and such loans cannot necessarily be aligned with banks’ own green financing / net zero targets. The specifics of the green transition investments can also play an important role here. The success and returns of disruptive and radical innovations are rather uncertain and need more time to monetize.[3] Thus higher risks must be taken into account, which could also affect banks’ risk appetite.

When talking about the green transition, banks have to deal with massive financing needs of their clients that need to be aligned with their own resources and targets. Therefore, capital and balance sheet management, including a stronger focus on RWA optimization, will be key for banks in order to participate in the green growth opportunities. Nevertheless, under the current conditions, it cannot be ruled out that capital will become a bottleneck factor, and further regulatory support (i.e. green supporting RWA factors) or increased involvement of capital markets may be required.