|

Getting your Trinity Audio player ready...

|

Were the interest rate hikes good or bad?

Senior executives and board members may – or should – have been puzzled by the divergence between the negative interest rate risk exposures of their institutions and the experienced strong growth in NII.

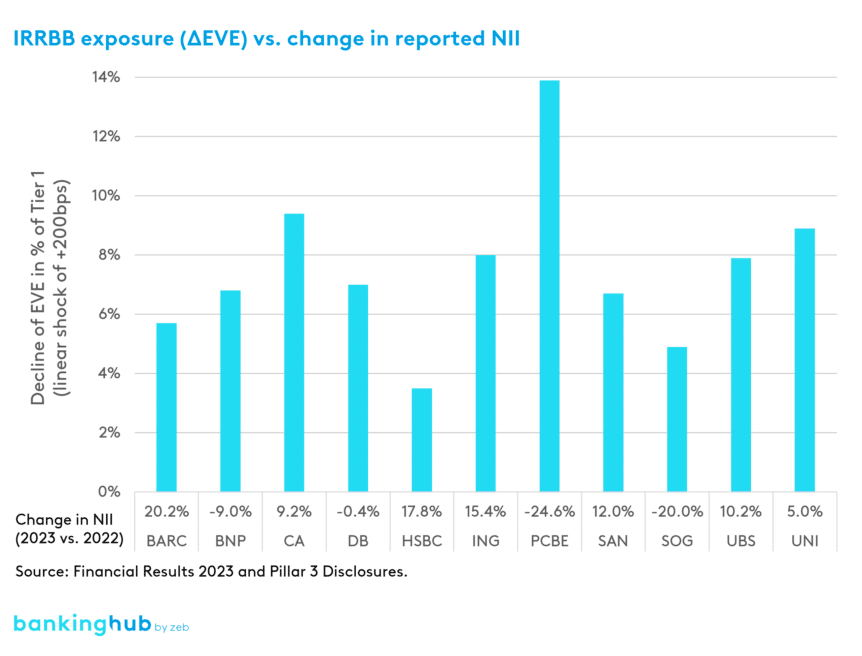

As shown in Figure 1, the largest European banks reported in their 2022 year-end IRRBB disclosures that a linear 200 bps upward shock to interest rates would negatively impact their EVE. In contrast, the NII increased for most banks in 2023 (French banks are a notable outlier). What explains this discrepancy?

Methodological differences between EVE and NII

First, it is important to understand that EVE and NII are two fundamentally different concepts.

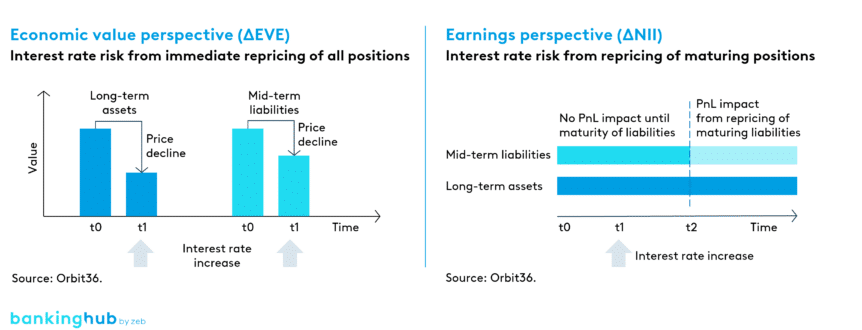

The EVE methodology measures the immediate present value impact of interest rate changes over the entire duration of all interest-bearing assets and liabilities (see figure 2: on the left), regardless of the accounting treatment. For this reason, EVE is seen as a proxy for the market value of a bank’s equity. Importantly, changes in EVE have no impact on capital ratios.

In contrast, earnings-based risk measures such as ΔNII capture the impact on earnings for a given period, considering the applicable accounting standards, such as accrual accounting for most banking book positions. This means that for some exposures, the impact of interest rate changes is only visible with a significant time lag (see figure 2: on the right).

Despite this limitation, the ΔNII view is important since it reflects the way capital ratios are calculated and dividend distributions are determined.

Given the different time horizons, ΔEVE and ΔNII do not necessarily have the same sign. For instance, if a bank has a surplus of short-term assets over short-term liabilities, it may be positively exposed to rising interest rates over the one-year time horizon used for ΔNII.

However, the same bank may have a funding gap in longer maturities, so that the overall present value change captured by ΔEVE is negative. Hence, whether the bank is positively or negatively exposed to rising interest rates depends on the measure used.

Material impacts not captured by ΔEVE

Since ΔEVE measures the impact of interest rate changes on the present value, assets and liabilities that are immediately due or repriced daily have only a marginal EVE impact. This has far-reaching implications.

For instance, higher monetary policy rates such as the deposit facility rate paid by the ECB on the banks’ overnight deposits, generate significant additional revenues that are not considered in ΔEVE. The same holds true for mortgages linked to a daily average overnight interest rate like the SARON mortgages in Switzerland.

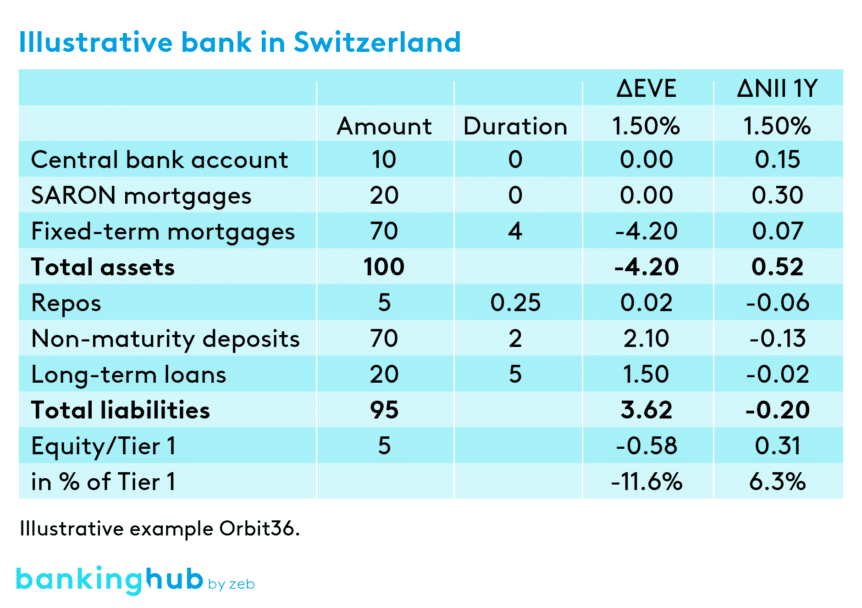

Figure 3 provides an illustrative example of a bank balance sheet. Since the bank is supposed to fund its long-term assets with a duration of 4 years predominantly with non-maturity-deposits (NMDs) with a shorter duration, the impact of a 150 basis point linear shock on ΔEVE is negative and amounts to 11.6% of the bank’s Tier 1 capital.

In contrast, the impact of the same interest rate scenario on ΔNII is positive. This effect is largely driven by the higher interest income on the central bank account and the SARON mortgages, which for the reasons mentioned above create only a minimal ΔEVE exposure.

As also visible from the figure, the higher interest income is only partially offset by higher interest expenses on the NMDs, repos and the portion of long-term loans repriced in the one-year period over which ΔNII is measured.

The example shows that the observed discrepancies between European banks’ ΔEVE exposures prior to the interest rate increases and the materially higher NII can be explained. Since the significant revenues that banks achieved on their central bank cash holdings and SARON mortgages in Switzerland were only marginally captured in the IRRBB exposures based on ΔEVE, ΔNII provided a more realistic picture of the impact of higher interest rates on the banks’ profitability.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Which IRRBB exposure should banks hedge?

Traditionally, regulators have paid more attention to ΔEVE than to ΔNII. For instance, in many jurisdictions, banks are identified as outliers if their ΔEVE-risk exceeds 15 percent of Tier 1 capital under any of the six interest rate scenarios specified by the Basel Committee. For this reason, some banks focus primarily on managing their ΔEVE exposure. A typical strategy for many small and mid-sized banks is to arrange payer swaps when their long-term assets create a ΔEVE exposure that exceeds their risk appetite.

In autumn 2022, the EBA announced the introduction of an additional outlier test based on the decline in NII. Under the final rules decided in 2023, the threshold for ΔNII over a one-year period was set at 5% of a bank’s Tier 1 capital. This could prove to be a game changer, as it is no longer evident which exposure the banks should hedge. If ΔNII and ΔEVE have different signs, the situation becomes tricky.

An effective hedging strategy must ensure that neither the 15% ΔEVE SOT nor the 5% ΔNII SOT thresholds are breached under the applicable regulatory scenarios. Within these boundaries, banks have room to optimize their hedging strategy and consider the trade-off between higher NII and increased margin volatility. The new situation requires banks to review the purpose of their hedging strategy.

Conclusion on the management of ΔEVE

In our view, the management of ΔEVE is crucial to avoid failure due to a loss of trust, e.g. in the case of large unrealized losses on assets as observed at Silicon Valley Bank and First Republic Bank. However, we see limited value in fine-tuning ΔEVE exposures.

Instead, we would focus the hedging strategies on optimizing ΔNII under the baseline and reasonably possible alternative scenarios, while keeping ΔEVE under control under all scenarios, including severe stress.

Besides regulatory considerations, banks should also be aware that 2023 could repeat itself with reverse signs if interest rates were to fall. While this does not appear to be a problem considering the banks’ negative ΔEVE exposure, the adverse impacts on NII could be large if the interest income on central bank accounts and SARON mortgages declines.

Given the observed shifts from overnight deposits to term-deposits and the increased popularity of SARON mortgages in recent quarters, the possible NII declines in future years could even more than offset the NII growth experienced in 2023. Banks are therefore advised to review their ALM and hedging strategies.