|

LISTEN TO AUDIO VERSION:

|

The evolution of Open Banking

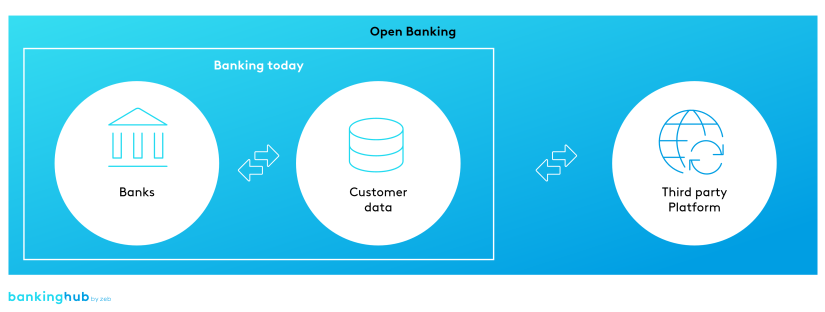

Open Banking emerged from the EU PSD2 regulation, whose original intent was to introduce increased competition and innovation into the financial services sector. PSD2 forces banks to offer dedicated APIs for securely sharing their customers’ financial data for account aggregation and payment initiation. Although PSD2 does not require a specific open standard, it sets a legal framework within which both the UK’s and the EU’s Open Banking standards (e.g. STET, Berlin Group) have to operate.

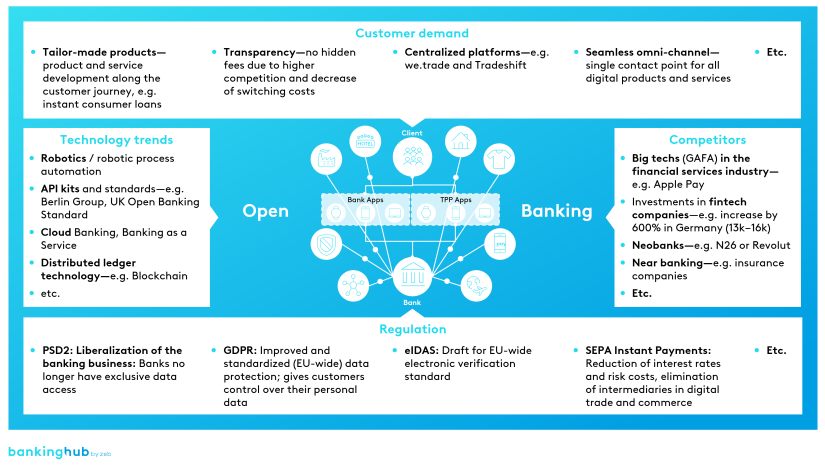

PSD2, however, is not the only trend forcing a shift of the sector towards Open Banking. We identify four general industry trends forcing incumbents to revise their business models in order to maintain their current market positions.

The combination of these four trends has resulted in the phenomenon that we call Open Banking.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Impact along three dimensions

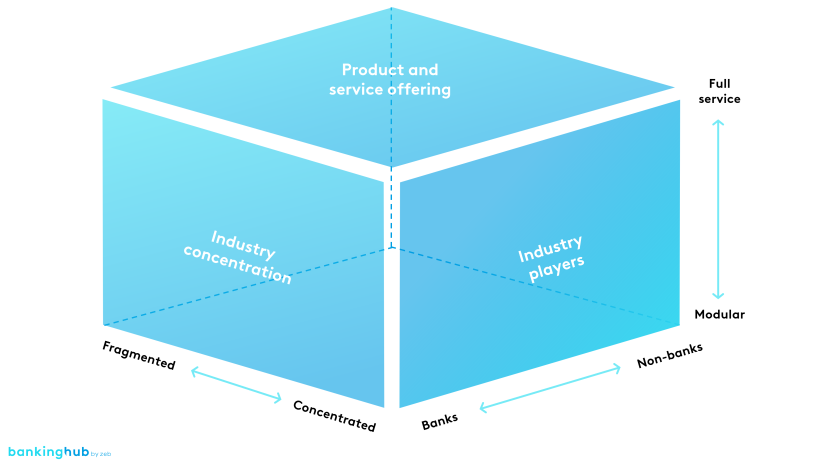

Open Banking is much more comprehensive than PSD2; it is a systematic paradigm shift in the way financial services are delivered along the entire value chain. We believe that the impact can be felt along three dimensions and will cause significant changes in banking ecosystems, platforms and portals.

- Product and service offerings

Will Open Banking result in a modularized product and service offering, i. e. some level of specialization, or will we continue to see full product and service offerings from established players within the future market? - Industry concentration

Will Open Banking result in a single EU-wide dominant platform, which, due to winner-takes-all effects, other financial services providers will be forced to use, or will multiple players and platforms be able to coexist in the future market? - Players

Will Open Banking allow non-bank players such as big techs (Apple, Facebook etc.) to enter the market, or will the traditional banks succeed in maintaining their market dominance in the financial services sector?

The direction along each of these axes must be carefully observed and can be influenced by multiple factors. Banks will be able to aggregate and distribute their (customer) data and services beyond the regulatory requirements in order to enrich their own product portfolio.

Conclusion

Banks and non-banks will be able to benefit from new partnerships and a broader base of accessible data from other financial and non-financial service providers by offering new value-added services to their customers. Services they do not have to build or run themselves.

Open Banking also enables banks to build relationships with external developers, which leads to a better understanding of both the market and the end users and also allows them to make smarter decisions about products and channels.

In summary, the PSD2 was brought to life to increase the competition in the financial services industry, but Open Banking reaches far beyond. It starts with a continuous improvement in customer centricity and leads to an increased financial integration with value-added services and further improvements such as the reduction of overdraft fees. It is clear that Open Banking will continue to change the classic bank-customer relationship and the banking business in general, long after PSD2 is in place.