What is crypto mining?

Crypto mining is a process in which computing power is made available to process transactions, verify them and synchronize all users in a blockchain network. This process is called “mining”, analogous to gold mining. To give “miners” an incentive to make their computing power available, mining is rewarded with native tokens of the respective blockchain. The payment amount depends on the computing capacity provided.

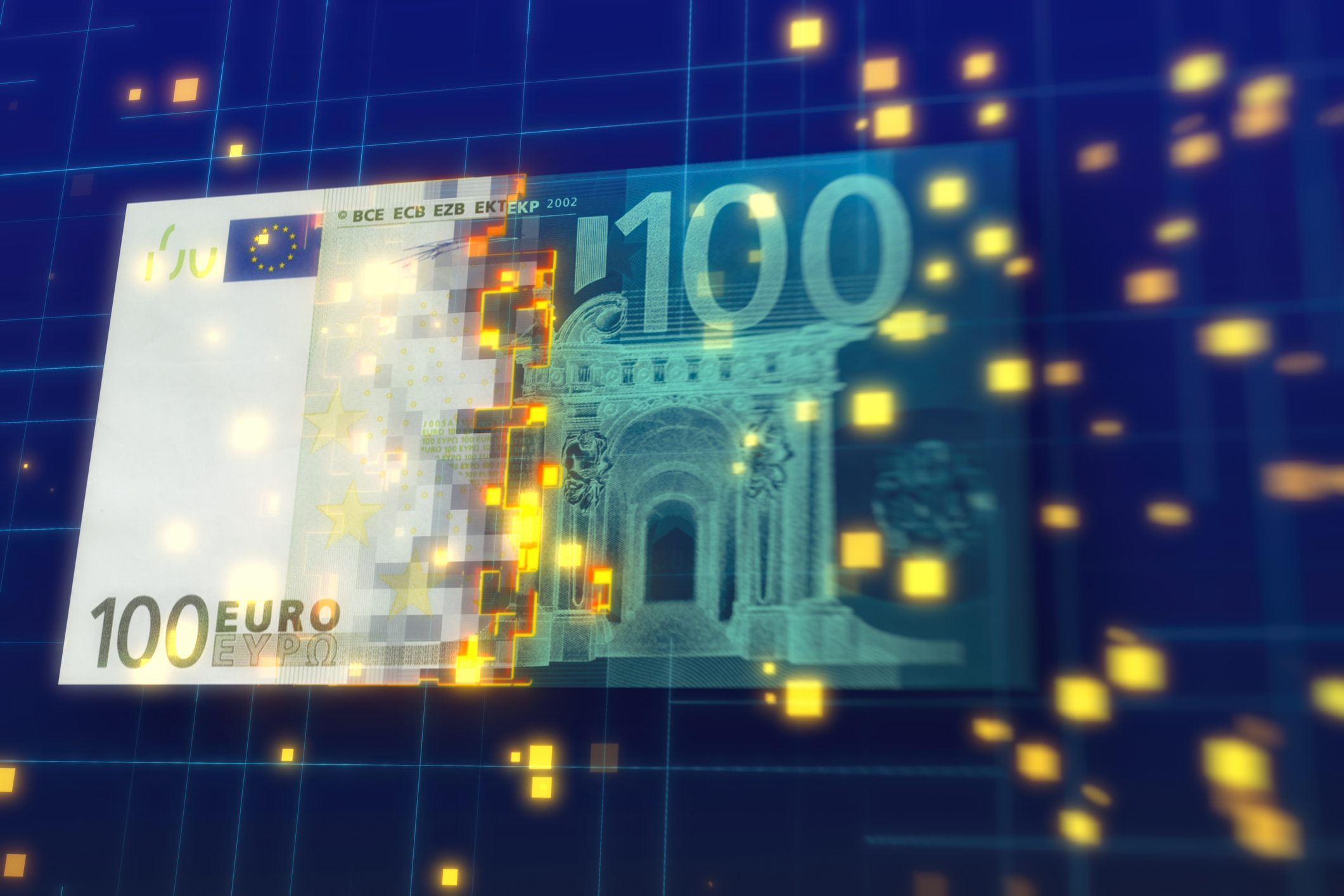

In traditional fiat currency systems, governments or central banks print additional money as required. In the case of cryptocurrencies such as Bitcoin, however, no money is printed. Instead, these currencies are “mined” in a complex mining process, and the underlying coins are only available in a limited number, which limits their replicability. The total availability of Bitcoins, for example, is limited to 21 million.

Numerous computers around the world compete in cryptocurrency mining. The more miners mine for a cryptocurrency, the more complex the so-called “difficulty” becomes, and the trickier it is to find a suitable block. This difficulty stabilizes the value of cryptocurrencies as it regulates the scope of mining. Without this difficulty, all tokens in a blockchain could be generated instantaneously.

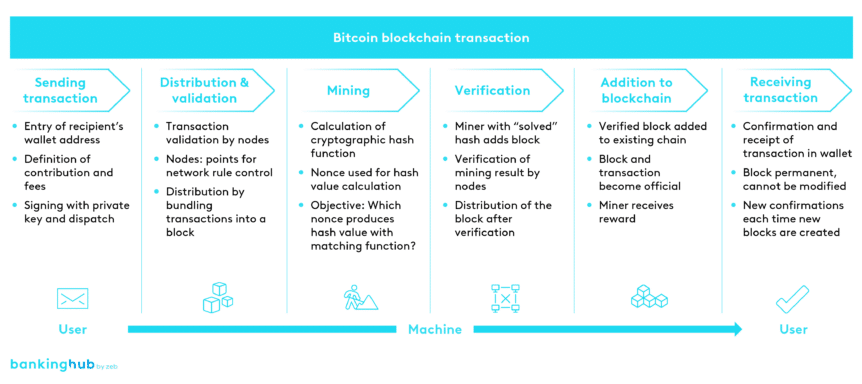

How does crypto mining work?

A blockchain network processes transactions by collecting all transactions from a specific period and combining them into a list – the so-called block. The miner’s task consists in confirming these transactions and entering them in a ledger for the corresponding block. Miners are rewarded for this in native tokens (the transaction fee).

However, the technical process of mining is kind of a competition. Figuratively speaking, all miners (computers) compete against each other to solve arithmetic problems. The solution is the so-called hash, which must be calculated without changing the transactions. Miners do this by using a different data set called a nonce, which is processed together with the hash.

They receive a reward if the nonce and hash match – so in effect these are like a lock and key. The challenge lies in finding the nonce, as this is done using an estimation process. The mining difficulty regulates the speed and effort of processing to prevent the rapid depletion of all tokens of a cryptocurrency and thus to maintain the value of the cryptocurrency. Mining success depends on machine processing power, time and, to a certain extent, luck.