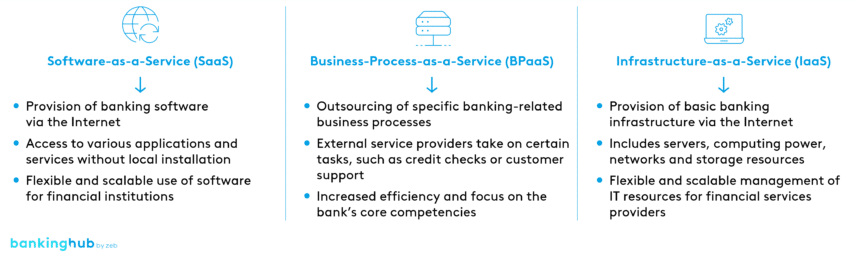

Forms of Banking-as-a-Service

- Banking-as-a-Service takes various forms, including Software-as-a-Service (SaaS), which is the provision of banking software via the Internet.

- Business-Process-as-a-Service (BPaaS) is a way to outsource specific business processes in banking.

- Infrastructure-as-a-Service (IaaS), on the other hand, denotes the provision of basic banking infrastructures such as servers and computing power via the Internet.

Why is BaaS relevant in banking?

BaaS in banking accelerates the development of innovative financial products. Outsourcing institutions can offer more powerful systems and processes and thus generate additional revenue. At the same time, sourcing companies can react more flexibly and quickly to new market conditions. Studies show that this can reduce operating costs by up to 30%.

Benefits of Banking-as-a-Service

- Agility and innovation: BaaS enables banks to make their services more agile and develop innovative products to market in a shorter period of time.

- Cost efficiency: By using external services, banks can reduce costs as they do not have to manage all processes internally.

- Access to technologies: Financial institutions can access the latest technologies without having to set up extensive IT infrastructure themselves.

Limitations of Banking-as-a-Service

The use of BaaS comes with challenges, including data protection and security concerns. The feeding of bank data into third-party systems requires robust security measures.

Moreover, financial institutions must ensure that their BaaS implementation complies with regulatory requirements – in particular the material outsourcing requirements pursuant to MaRisk AT 9 – and data protection guidelines.

BaaS: supplementary custom development

The integration of custom development can contribute to overcoming the limitations of BaaS. By developing customized applications, financial institutions can meet their own specific requirements while benefiting from the advantages of BaaS.

This combination allows for more flexible and bespoke solutions while ensuring regulatory compliance. The synergy between BaaS and custom development paves the way for a transformation of the German financial landscape.

If we have omitted a provider or a system, please send us a short message via the contact form. Your feedback helps us keep this market overview up-to-date and ensure its comprehensiveness. Many thanks for your support!

Which banks and institutions may benefit from BaaS?

A combination of BaaS and custom development is a solid basis for developers to build upon. APIs allow them to create bespoke solutions tailored to specific customer needs. According to a report by Gartner, 90% of new corporate applications could be API-based by 2025. This shows the great potential of BaaS integration and custom development.

In particular smaller banks and up-and-coming fintech start-ups can benefit from BaaS by gaining access to established banking services. Larger institutions can use BaaS as a means of diversifying their service portfolio and intensifying their digitalization strategies.

It is expected that 70% of banks worldwide will integrate BaaS into their business models by the end of 2024 in order to strengthen their competitive position.

Banking-as-a-Service providers in Germany

Banking-as-a-Service (BaaS) has become a major trend in the German financial sector as financial institutions and fintech companies alike increasingly rely on external service providers when it comes to the development of innovative financial products.

The following market overview provides an insight into some of the leading BaaS providers in Germany, including their respective offerings and target groups.

PROVIDERS

CATEGORY

LICENSE

OFFER

USERS

IaaS, BaaS

BaaS for credit processes, banking solutions

Banks, financial services providers

BaaS

Digital banking platform, integrated BaaS functions

Banks, financial institutions

BaaS

E-money license

BaaS for corporate accounts, payments

Banks, companies

IaaS, BaaS

Comprehensive financial technology solutions, BaaS options

Fintech companies, banks

IaaS, BaaS

Cloud-native banking platform, APIs for financial products

Fintech companies, banks, microfinance institutions

BaaS

Banking license, e-money license

Complete banking platform, APIs for third-party providers

Fintech companies, banks, start-ups

BaaS, BPaaS

Bank licensing

White label banking, investment products

Fintech companies, banks

BaaS

E-money license

BaaS for payment services

Fintech companies, banks

BPaaS

Banking license

BaaS for credit products, installment loans

Banks

BPaaS

E-money license

Fintech companies, banks

BaaS

BaaS for payment and account management services

Fintech companies, banks

![Thede Küntzel, Manager Projects & Innovation at Sparkasse Bremen and Managing Director of ÜberseeHub GmbH.]](https://en.bankinghub.comlounge.dev/wp-content/uploads/2023/04/thede-kuentzel-bankinghub-768x549.jpg)